Work Opportunity Tax Credit (WOTC)

The Work Opportunity Tax Credit (WOTC) provides employers a federal income tax credit for employing personnel from specific selected groups. Tax Credit Group, Inc. provides administrative services to help Companies/Corporations through the Screening and Administrative process.

Work Opportunity Tax Credit (WOTC) Program is a federal tax incentive program that was designed to encourage employers to hire individuals who have historically faced barriers to employment. Each qualified new employee generally entitles you to a tax credit of either 25% or 40% of the first $6,000 in wages earned during the certified employee’s first year of employment. The maximum credit is $9,600 for qualifying veterans.

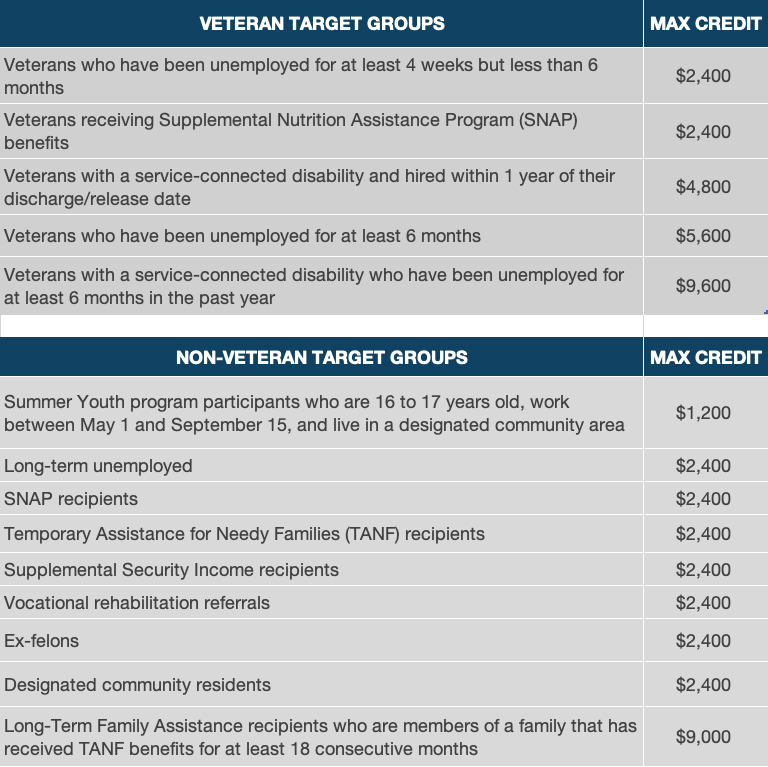

The WOTC program offers employers a tax credit against their federal tax liability for hiring individuals from any one of the target groups:

- Welfare Recipient (TANF) – Member of a family receiving Temporary Assistance for Needy Families (TANF) payments for any nine-month period during the 18 months preceding the employee’s start date.

- Ex-Offenders – An individual who has been convicted of a felony or released from prison in the 12 months prior to the individual’s start date.

- Designated Community Resident – An 18-39 year old resident of one of the federally designated Empowerment Zones (EZs) or Rural Renewal Counties.

- Vocational Rehabilitation – An individual who completed or is completing a vocational rehabilitative program, individual work plan or Department of Veterans Affairs rehabilitative program.

- Summer Youth – An individual aged 16-17, who is hired between May 1 and September 15 and who lives in a Federal Empowerment Zone, Enterprise Community, Renewal Community or Rural Renewal County.

- Food Stamp Recipients – An individual aged 18-39, who is a member of a family that has received food stamps for six months prior to the start date, OR received food stamps for at least three months of the five-month period ending on the start date.

- SSI Recipient – An individual who is receiving supplemental security income benefits for any month ending within the 60-day period ending on the start date.

- Long Term Family Assistance Recipients (formerly Welfare-to-Work)

An individual who is a member of a family: That received Temporary Assistance for Needy Families (TANF), for at least the 18 consecutive months ending on the starting date; OR Whose TANF eligibility expired under federal or state law after August 5, 1997, for applicants hired within two years after their eligibility expired; OR That received TANF for a total of at least 18 months (whether or not consecutive), beginning after August 5, 1997, and has a starting date that is not more than two years after the end of the earliest 18-month period. - Long Term Unemployed – An individual who has been unemployed at least 6 months and received unemployment compensation under state or federal law.

- Qualified Veteran – A veteran who is any of the following:

- A member of a family receiving assistance under a food stamp program for at least three months, all or part of which is during the 12 months ending on the hiring date.

- Entitled to compensation for a service-connected disability and has a hire date that is not more than a year after having been discharged or released from active duty; or has a period of unemployment of six months or more during the one-year period ending on the hire date.

- Has a period of unemployment of at least four weeks, but less than six months, during the one-year period ending on the hire date.

- Has a period of unemployment of at least six months during the one-year period ending on the hiring date.

Calculating the Work Opportunity Tax Credit (WOTC)

Most target groups’ maximum credit is $2,400. The following groups are eligible to receive a higher maximum credit:

- $4,800 for each veteran with a service-connected disability that is hired within one year of their discharge date.

- $5,600 for each veteran that is hired and was unemployed for at least six months prior to being hired.

- $9,000 for each new hire that is a member of a family that has received TANF benefits for at least 18 consecutive months prior to their hire date.

- $9,600 for each veteran with a service-connected disability that is hired and was unemployed for ate least six months prior to being hired.